Needs | Disability Insurance | Income Insurance

WHAT IS INCOME INSURANCE?

Whether the result of accidental injury or illness, a disability can prevent you from earning a living. Income insurance provides you with an income should you become disabled and unable to support yourself.

Why purchase income insurance?

Most people recognize the importance of life insurance, but many do not see the need for income insurance. And yet, if you become disabled due to either illness or injury, your income will stop but your bills will continue to pile up. It is therefore important to have a guaranteed income to pay your bills.

Did you know…

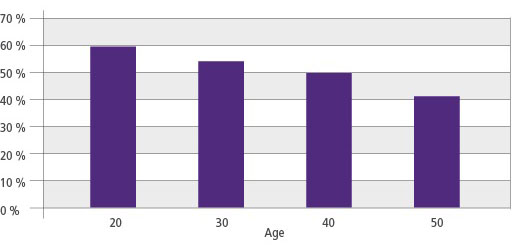

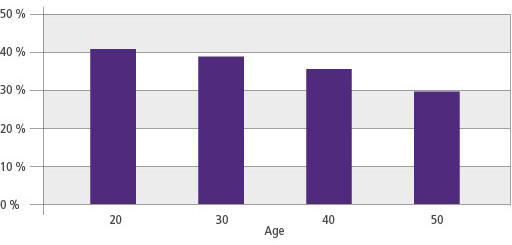

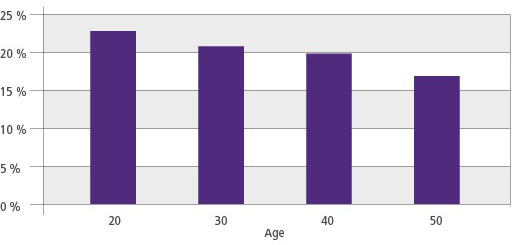

Probability of being disabled for 90 days or more at least once before reaching 65 years of age.

Manual (blue collar) workers – B and 1A

Supervisory Work – 2A

Office Work (white collar workers) – 3A and 4A

Source: Commissioners Individual Disability Table A (1985 CIDA). Data on male smokers and non-smokers.

How much income insurance do you need?

That depends on a number of factors:

- Your lifestyle – How much money do you need to live today? Would you be okay with a drop in your standard of living?

- Your family responsibilities – How many people depend on your income? Are you a single parent or do you have financial responsibilities as a non-custodial parent? Are your parents, brothers or sisters dependent on you?

- Your debts – Who would make payments on your car loan or mortgage if you no longer earned an income? How long would your savings last?

- Your financial resources – Do you have any savings or income-producing investments? How long would your savings allow you to support yourself?

- Your dreams – What would happen to your plans for the future or your retirement, for your family and yourself, if you were to become disabled and use up your savings?

Source: Canadian Life and Health Insurance Association, “A guide to disability insurance”, 2012.

What are your needs?

To assess your insurance needs, it is always recommended that you consult a duly-authorized Broker (Financial Security Advisor). If you do not have one, please let us know by email at info@humania.ca and we will put you in touch with a Broker (Financial Security Advisor) in your area.

You can also calculate your disability insurance needs with our online tool.

For more information regarding our Insurance Without Medical Exam required, speak to your Broker (Financial Security Advisor), or send us your questions by email at info@humania.ca or else call us at 1-800-773-8404, Monday to Friday between 8 a.m. and 5 p.m. (Eastern time).