Needs | Critical Illness Insurance

WHAT IS CRITICAL ILLNESS INSURANCE?

Hundreds of thousands of Canadians suffer from serious illnesses each year. Thanks to advances in medical science, the majority will survive. But recovery is often long and expensive. That is where critical illness insurance can help.

What is critical illness insurance?

Critical illness insurance pays out a lump sum, when you suffer from and survive one of the critical illnesses listed in your policy. It is a living benefit that is paid to you directly, after the minimum survival period. The lump sum payment is yours to do with as you please. It can be used to pay for treatments outside Canada, to modify your home with accessibility features, to cover the cost of your family travelling to visit you at a treatment centre, or just to pay for a much-needed vacation. The choice is yours.

Illnesses covered by Humania Assurance - Insurance Without Medical Exam include:

- Stroke

- Cancer

- Coronary artery bypass

- Heart attack (myocardial infarction)

Who needs this insurance?

Critical illness insurance is not just for the elderly. Certain covered conditions can affect you no matter what your age. Choosing critical illness insurance lets you plan freely how you will live your life after a serious medical event.

How many cancers are diagnosed every year?

In Canada in 2010, “an estimated 173,800 new cases of cancer and 76,200 cancer deaths are expected”.

What cancers occur most frequently?

LUNG CANCER

an estimated 24,200

new cases in 2010

BREAST CANCER

an estimated 3,200

new cases in 2010

“Half of the new cases of breast cancer occur in women age 50 and 69.”

PROSTATE CANCER

an estimated 24,600

new cases in 2010

“Prostate cancer will be diagnosed most frequently in men age 60-69 years old.”

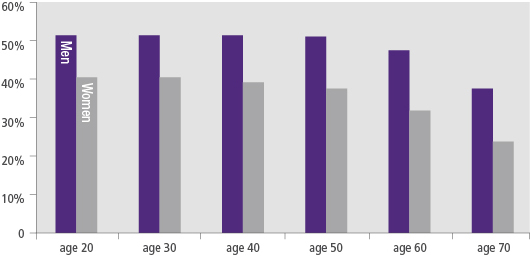

At what age is cancer most often diagnosed?

- 5.7 out of 10 (57%) cancers affect people under the age of 70

- 4.3 out of 10 (43%) cancers affect people age 70 and over

All cancer statistics and citations are drawn from: Canadian Cancer Society's Steering Committee: Canadian Cancer Statistics 2010. Toronto: Canadian Cancer Society, 2010.

Every hour:

- 16.65 people will learn that they have cancer

- 8 will die from cancer

Proportion of deaths due to cancer and other causes, Canada, 2005

Source: All cancer statistics and citations are drawn from the “Canadian Cancer Society's Steering Committee”:

Canadian Cancer Statistics 2010. Toronto:

Canadian Cancer Society, 2010.

Each year:

- 145,500 people will learn that they have cancer

- 68,300 will die from cancer

- 80,000 will have a heart attack (myocardial infarction)

- 45,000 will have a stroke

- 23,000 will undergo coronary bypass surgery

Lifetime risk:

- 1 person out of 3 will develop some form of cancer

- 1 woman out of 9 is likely to have breast cancer

- 1 man out of 8 is likely to have prostate cancer

Source Munich Re Group

What are your needs?

To assess your insurance needs, it is always recommended that you consult a duly-authorized Broker (Financial Security Advisor). If you do not have one, please let us know by email at info@humania.ca and we will put you in touch with a Broker (Financial Security Advisor) in your area.

You can also calculate your critical illness insurance needs with our online tool.

For more information regarding our Insurance Without Medical Exam required, speak to your Broker (Financial Security Advisor), or send us your questions by email at info@humania.ca or else call us at 1-800-773-8404, Monday to Friday between 8 a.m. and 5 p.m. (Eastern time).