Needs | Disability Insurance | Debt Insurance

WHAT IS DEBT INSURANCE IN CASE OF A DISABILITY?

In the event of an accident or critical illness, disability debt insurance covers your monthly debt payments so you can focus on getting better without having to worry about creditors.

With a single contract, you can cover a full range of debts owed to any number of creditors, which are sure to change over time. Opt for 10- or 20-year term insurance with a renewal option in effect until you reach age 65.

Why take out debt insurance?

If you become disabled as a result of illness or accident, your income stops but your bills continue to accumulate.

Did you know...

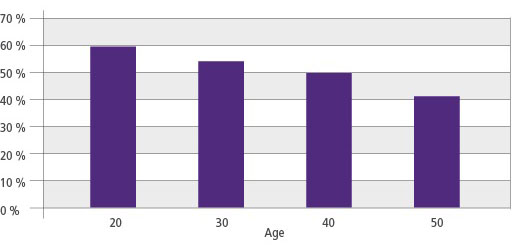

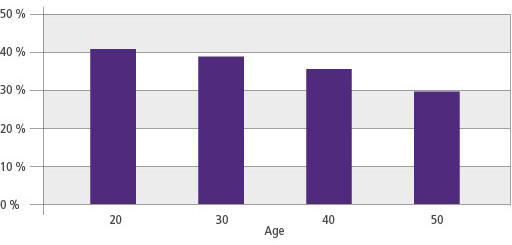

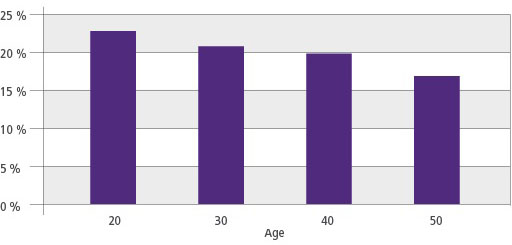

Probability of being disabled for 90 days or more at least once before reaching 65 years of age:

Supervisory Work – 2A

Office Work (white collar workers) – 3A and 4A

Source: Commissioners Individual Disability Table A (1985 CIDA). Data on male smokers and non-smokers.

Why take out personal debt insurance?

The table below illustrates the advantages of personal debt insurance compared to coverage offered by lenders or creditors.

LENDER/CREDITOR

PERSONAL DEBT INSURANCE CONTRACT

POLICY OWNER AND BENEFICIARY

The creditor is the policy owner and is its beneficiary.

You own the policy.

You can name the beneficiaries who will receive the monthly benefits, or you can receive the monthly benefits and pay the creditors yourself.

TERM OF THE LOAN

For mortgages and cars, the term of the loan is usually 5 years. After the initial term, you must re-apply with the same institution or choose a different one.

You are covered for the entire term, either 10 or 20 years.

TRANSFERABILITY

Any change in lender means that the client must once again prove eligibility for coverage, and the rates may change.

You remain covered for 10 or 20 years, and your coverage remains renewable without medical exam until age 65.

How much debt insurance do you need?

In the event of disability, you can protect all of your assets. Whether you want to cover bank loans, rent, lines of credit, credit cards, student loans or car and major appliance loans, all of your monthly debts to any financial institution should be covered in the event of disability resulting from illness or accident.

Needs analysis

When calculating your insurance needs, you should always consult a licensed financial security advisor. If you do not currently have a financial security advisor, email us at info@humania.ca and we will put you in touch with a financial security advisor in your area.

For more information regarding our Insurance Without Medical Exam required, speak to your Broker (Financial Security Advisor), or send us your questions by email at info@humania.ca or else call us at 1-800-773-8404, Monday to Friday between 8 a.m. and 5 p.m. (Eastern time).